how much is my paycheck after taxes nj

Important note on the salary paycheck calculator. Your average tax rate is 1198 and your marginal tax rate is 22.

Nj 500 Rebate Check How To Get Them When They Arrive

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

. New Jersey has a progressive income tax policy with rates that go all the way up to 1075 for gross income over 5 million. The state income tax rate in New Jersey is progressive and ranges from 14 to 1075 while federal income tax rates range from 10 to 37 depending on your income. How much is the tax in New Jersey.

If youd like to calculate the overall percentage of tax deducted from your paycheck. What is 1200 after taxes. Federal payroll taxes in New Jersey.

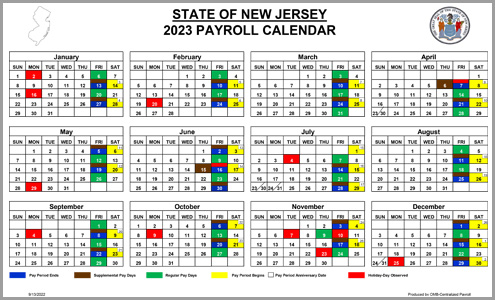

NJ Taxation Effective January 1 2020 the tax rate on that income bracket increases from 897 to 1075 regardless of filing status. New Jersey State Payroll Taxes. New Jersey Salary Paycheck Calculator.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in New Jersey. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. The base state sales tax rate in New.

Total annual income Income tax liability Payroll tax liability Pre-tax deductions Post. You are able to use our New Jersey State Tax Calculator to calculate your total tax costs in the tax year 202223. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

The New Jersey taxable wage base for 2022 for unemployment insurance is 39800. After taxes youd clear about 106 a day. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

This New Jersey hourly paycheck calculator is perfect for those who are paid on. Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Jersey paycheck calculator. New Jersey Hourly Paycheck Calculator.

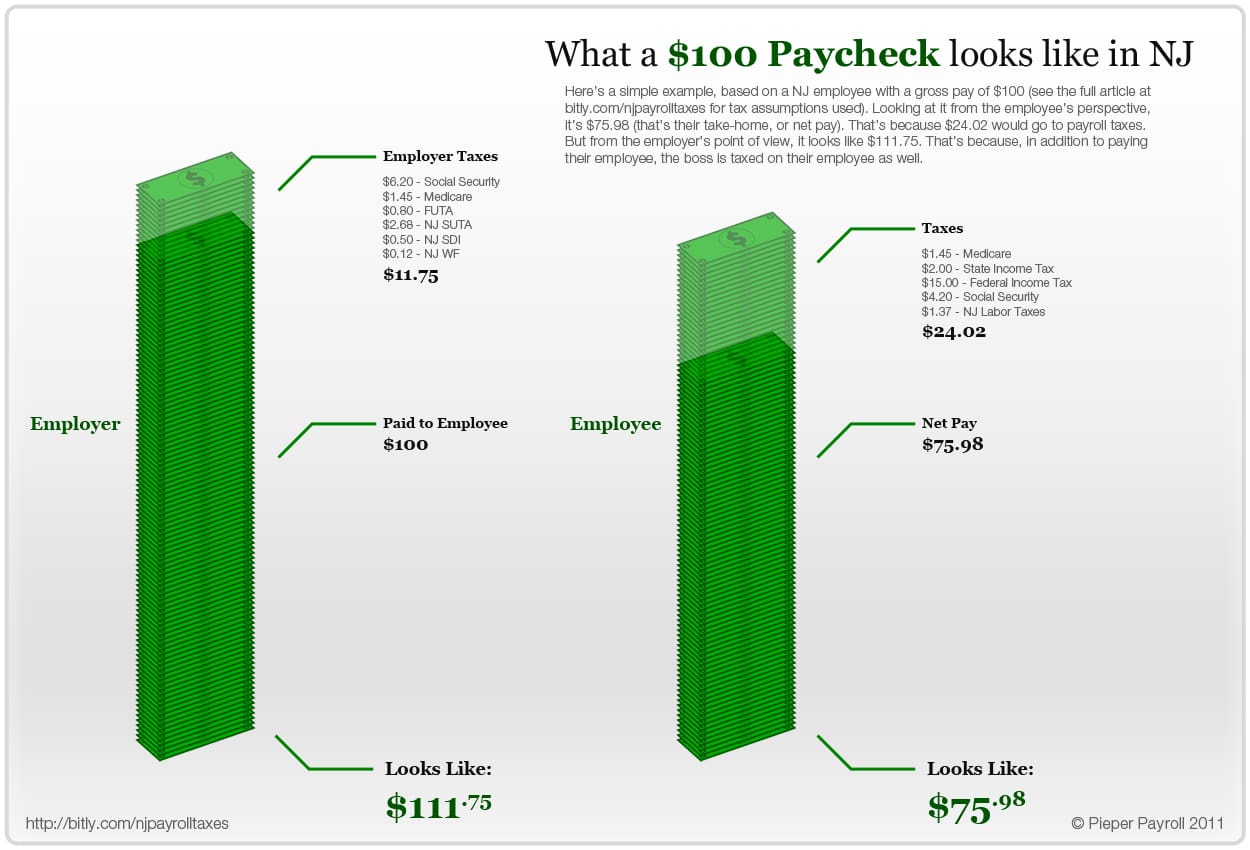

The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare. If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783. Here are four federal payroll taxes that you will want to know about.

The new payroll tax law allows New Jersey municipalities to impose a payroll tax on businesses of up to 1 of wages. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. This income tax calculator can help estimate your average income tax rate and your take home pay.

For instance an increase of 100 in your salary will be taxed 3601 hence your net pay will only increase by 6399. This marginal tax rate means that your immediate additional income will be taxed at this rate. How do I calculate the percentage of taxes taken out of my paycheck.

Your average tax rate is 217 and your marginal tax rate is 360. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. 15 an hour will net you 120 for an 8-hour workday.

Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Federal income tax FIT FIT is paid by employees via payroll deductions. Income over 5 million is already subject to this rate.

To calculate your daily pay. Our calculator has been specially developed in. Take your hourly salary 15 and multiply by 8 hours worked per day.

How Your Paycheck Works. Once you have worked out your total tax liability you minus the money you put aside for tax withholdings every year if there is any and any post-tax deductions. Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay.

Tax brackets vary based on filing status and income. For most of the Garden State there are no. Switch to New Jersey.

This marginal tax rate means that.

Mega Millions Jackpot Hits 830m Here S How Much Taxes You D Pay Nj Com

New Jersey Paycheck Calculator Smartasset

What Is Local Income Tax Types States With Local Income Tax More

Commuter Tax Benefits Nj Transit New Jersey Transit Corporation New Jersey

Nj Division Of Taxation Trenton Us Facebook

New Jersey Income Tax Calculator Smartasset

2022 State Tax Reform State Tax Relief Rebate Checks

New Jersey Tax Rate 2017 Nj Employment Payroll Taxes

State W 4 Form Detailed Withholding Forms By State Chart

Payroll Taxes And Wage Withholding Login

New Jersey Minimum Wage 2022 Minimum Wage Org

Nj Division Of Taxation File Pay

Payroll Services In New Jersey Adp

New Jersey Income Tax Calculator Smartasset

Nj Division Of Taxation Nj 1040 And Nj 1041 E File Mandate Faq

New Jersey Paycheck Calculator 2022 With Income Tax Brackets Investomatica